Woodside Contingent Payment – up to US$55 million

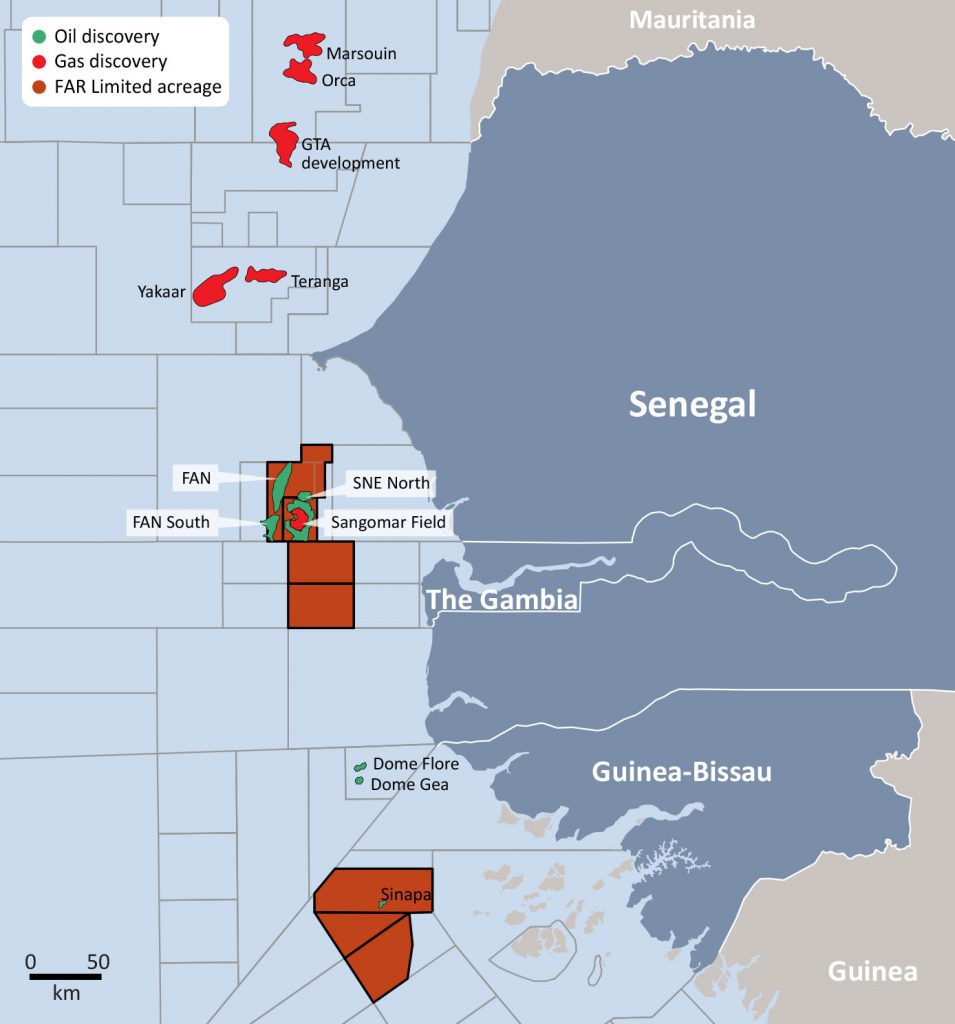

In July 2021, FAR completed the sale of its entire interest in the Senegal RSSD Project to Woodside in a transaction approved at a general meeting of shareholders held on 28 April 2021.

FAR received US$126 million in cash from Woodside on completion of the sale on 7 July as well as rights to a contingent payment, as consideration for the sale of its interest in the RSSD Project.

The contingent payment of up to US$55 million is payable in the future based on various factors relating to the sale of oil from the RSSD Project.

The contingent payment comprises 45% of entitlement barrels (being the share of oil relating to FAR’s 13.67% RSSD Project exploitation area interest) sold over the previous calendar year multiplied by the excess (if any) of the crude oil price per barrel (capped at US$70) and US$58.

The contingent payment terminates on the earliest of 31 December 2027, 3 years from first oil being sold (excluding any periods of zero production), and a total contingent payment of US$55 million being reached.

Woodside’s holding company, Woodside Petroleum Limited, is Operator of the Sangomar oil development and made an announcement on the progress of the Sangomar project development on 18 Febraury 2022, which indicated the development is on track for first oil in 2023. Woodside, may update timetables to first oil and production targets from time to time.

More information

For further information and up-to-date progress on FAR’s Senegal licences, please visit the Announcements & Reports section of the Company website and refer to our announcement dated 7 July 2021.